The WACC is cost of the financing for the firm. A firm can be financed by 2 main sources, the debt or cost of debt (borrowing from a back or any financial institution or issuing bonds) and the equity or cost of debt (from their own shareholders). If the company is only funding through the shareholders, its WACC would be the same than the Cost of equity.

But if we have a different proportion of cost of equity and cost of debt, we have to make and weighted average, therefore this is as simple as this formula.

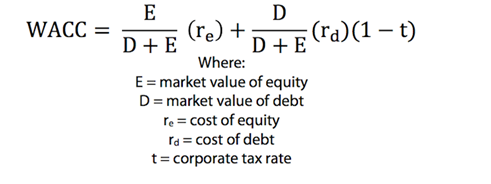

Or if we want a more sophisticated formula to show how difficult the finance are we can use this one:

Example

Assume newly formed Corporation ABC needs to raise $1 million in capital so it can buy office buildings and the equipment needed to conduct its business. The company issues and sells 6,000 shares ofstock at $100 each to raise the first $600,000. Because shareholders expect a return of 6% on theirinvestment, the cost of equity is 6%.

Corporation ABC then sells 400 bonds for $1,000 each to raise the other $400,000 in capital. The people who bought those bonds expect a 5% return, so ABC's cost of debt is 5%.

Corporation ABC's total market value is now ($600,000 equity + $400,000 debt) = $1 million and its corporate tax rate is 35%. Now we have all the ingredients to calculate Corporation ABC's weighted average cost of capital (WACC).

WACC = (($600,000/$1,000,000) x .06) + [(($400,000/$1,000,000) x .05) * (1-0.35))] = 0.049 = 4.9%

Corporation ABC's weighted average cost of capital is 4.9%

Corporation ABC's weighted average cost of capital is 4.9%

0 comentarios:

Publicar un comentario