1.Profitability index

Profitability index is an investment appraisal technique calculated by dividing the present value of future cash flows of a project by the initial investment required for the project.

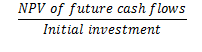

Profitability Index= Present Value of Future Cash Flows/Initial Investment Required.

Or Profitability Index= 1 + NPV / Initial Investment Required.

Profitability index is actually a modification of the net present value method. While present value is an absolute measure (i.e. it gives as the total dollar figure for a project), the profibality index is a relative measure (i.e. it gives as the figure as a ratio). The PI can also be thought of as turning a project's NPV into a percentage rate.

Difference with the NPV: However, the profitability index differs from NPV in one important respect: being a ratio, it ignores the scale of investment and provides no indication of the size of the actual cash flows.

Decision Rule

Accept a project if the profitability index is greater than 1.

Stay indifferent if the profitability index is 1.

Don't accept a project if the profitability index is below 1.

If there are 2 Projects with a positive NPV and Profitability Index above 1, we should pick that one with the higher NPV

2. The Yield Index (YI)

it´s conceptually very similar to the Profitability Index.

Decision Rule: Accept Project if YI > 0

The limitations of the Profitability Index hold also for the Yield Index.

0 comentarios:

Publicar un comentario