In short we are trying to know if a share is cheap or expensive by comparing the share price to the book value of firm assets. And we are going to use this comparison to work out if the share has a good value or looks overpriced. So how can we calculate it ?

First we need the share price comparing with something called book value per share. The book value per share is to know what the company owns in term of assets per share. To know that we have to check the balance sheet, which is a list of what a company owns, what it owes to the people and the net total. So for example using a normal house which worth $200k (assets because is something that I own), but I have a mortgage of $50k (liabilities, something that I owe).

So if we take the assets and deduct the mortgage, my net ownership is only $150k. So companies do the same thing, they list the assets, take away they liabilities and the result is a net amount called total equity.

For example instead of a house we are going to use the company "Tesco". In case of Tesco they have stores and debt to finance themselves. After getting the book value, we have to divide it by the number of shares.

Using some numbers

This means for every share share Tesco has €1,84 worth is assets, such as stores and so on. However what we want to do is compare this book value per share with the price per share. I can look up Tesco share price which is now around $4,30.

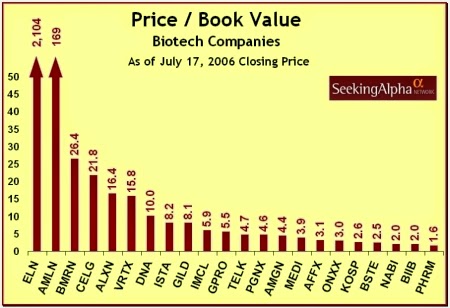

The 2.3 4x (times) in other words, the price of the share is 2.34 times the book value. Is that good or bad? Like all ratios we have to compare it with the competitors. However if you P/B ratio is below 1 suggests that actually you are getting a bargain buying this share, in other words you are buying the assets of the company paying per share for the less than it worth. And more than 1 or even 2, you have to be careful because maybe you are going to pay a lot for the shares.

However this ratio is going to be more useful when assets are the key driver for investor, in other words the company assets are your base to buy shares not its earnings, or its cash-flows or the dividends, because in that case we should use other ratios. So it´s a rule of thumb that this ratio is more useful in assets intensive sectors. In Tesco is quite useful but it´s not the only one to use.

0 comentarios:

Publicar un comentario